Harvard Collection Services: Can ‘Pay for Delete’ Repair Your Credit?

Are you grappling with debt collection notices from Harvard Collection Services and wondering if a ‘pay for delete’ agreement is a viable option to protect or repair your credit score? You’re not alone. Many individuals facing debt collection seek ways to resolve their obligations while minimizing the long-term impact on their financial health. This comprehensive guide dives deep into the concept of ‘pay for delete’ with Harvard Collection Services, exploring its potential benefits, risks, and alternatives. We aim to provide you with expert insights and actionable strategies to navigate this complex situation effectively. We’ll equip you with the knowledge to make informed decisions and take control of your financial future, offering a level of detail and nuance unmatched by other resources. We will cover Harvard Collection Services in detail, and also discuss how to handle debt collectors in general.

Understanding ‘Pay for Delete’ with Harvard Collection Services

The ‘pay for delete’ agreement is a negotiation strategy where you agree to pay off a debt in exchange for the collection agency removing the negative information from your credit report. It’s a tempting solution for those seeking to improve their credit score quickly. However, the effectiveness and ethical considerations surrounding ‘pay for delete’ vary depending on the collection agency and the specific circumstances. In the context of Harvard Collection Services, understanding their policies and practices regarding ‘pay for delete’ is crucial before pursuing this approach.

What is ‘Pay for Delete’?

‘Pay for delete’ is an agreement you make with a debt collector like Harvard Collection Services. You promise to pay the outstanding debt, and in return, they agree to remove the negative credit entry from your credit report. This can potentially boost your credit score, especially if the debt is relatively recent and significantly impacting your creditworthiness. The theory is that by removing the negative mark, your credit history appears cleaner, making you a more attractive borrower to lenders.

The Nuances of ‘Pay for Delete’ Agreements

It’s important to understand that ‘pay for delete’ is not a legally mandated practice. Collection agencies are not obligated to agree to it. Some agencies, including Harvard Collection Services, may have policies against it. Furthermore, even if an agency agrees verbally, there’s no guarantee they’ll follow through without a written agreement. This highlights the importance of documenting all communications and securing a written agreement before making any payments.

Is ‘Pay for Delete’ Ethical and Legal?

The ethics and legality of ‘pay for delete’ are often debated. Some argue that it’s a deceptive practice because it removes accurate information from credit reports. Others argue that it’s a fair negotiation tactic, especially if the original debt was subject to errors or disputes. From a legal standpoint, ‘pay for delete’ is not explicitly illegal, but it can violate the terms of agreements between collection agencies and credit bureaus. Credit bureaus generally prefer accurate reporting, and ‘pay for delete’ can be seen as circumventing this principle.

Harvard Collection Services: A Closer Look

Harvard Collection Services is a debt collection agency that purchases or manages debt portfolios from various creditors. Understanding their specific business practices and approach to debt collection is essential when considering a ‘pay for delete’ strategy.

Who is Harvard Collection Services?

Harvard Collection Services, like many debt collection agencies, operates by contacting individuals who allegedly owe debts to their clients. These debts can originate from various sources, including credit card companies, healthcare providers, and other businesses. They attempt to recover these debts, often through phone calls, letters, and other forms of communication. Their tactics and practices can vary, making it crucial to understand your rights and options when dealing with them.

Harvard Collection Services’ Reputation and Practices

Researching Harvard Collection Services’ reputation through the Better Business Bureau (BBB) and consumer forums can provide valuable insights into their practices. Look for patterns of complaints related to harassment, inaccurate reporting, or failure to honor agreements. This research can help you anticipate potential challenges and prepare accordingly. Consumer reviews often highlight the negotiation strategies that have worked (or failed) for others, providing a real-world perspective on dealing with this agency.

Contacting and Communicating with Harvard Collection Services

When dealing with Harvard Collection Services, it’s crucial to maintain a record of all communications. Send all correspondence via certified mail with return receipt requested to ensure proof of delivery. Be polite but firm, and clearly state your intentions. Avoid providing any personal information beyond what is necessary to verify the debt. Remember, you have the right to request validation of the debt, which requires the collection agency to provide proof that you owe the debt and that they have the legal right to collect it.

The Role of Debt Validation in the ‘Pay for Delete’ Process

Before even considering a ‘pay for delete’ agreement, it’s essential to request debt validation from Harvard Collection Services. This process can uncover inaccuracies or errors in the debt, which could potentially lead to its dismissal. Debt validation is a right granted to you under the Fair Debt Collection Practices Act (FDCPA).

What is Debt Validation?

Debt validation is a formal request you make to a collection agency to provide proof that the debt is valid. This includes information such as the original creditor, the account number, the amount owed, and documentation showing that you are legally obligated to pay the debt. The FDCPA requires collection agencies to cease collection efforts until they provide this validation.

How to Request Debt Validation from Harvard Collection Services

Send a written debt validation request to Harvard Collection Services via certified mail within 30 days of receiving their initial communication. Use a template letter readily available online to ensure you include all necessary information. Clearly state that you are requesting validation of the debt and that you are not admitting to owing the debt. Keep a copy of the letter and the return receipt for your records.

What to Do if Harvard Collection Services Fails to Validate the Debt

If Harvard Collection Services fails to provide adequate debt validation within the required timeframe, they are legally obligated to stop collection efforts. You can then dispute the debt with the credit bureaus, which may result in its removal from your credit report. Even if they provide some documentation, carefully review it for errors or inconsistencies. If you find any, dispute the debt with both the collection agency and the credit bureaus.

Negotiating a ‘Pay for Delete’ Agreement: Strategies and Tactics

If debt validation doesn’t lead to the debt’s dismissal, you can explore the possibility of a ‘pay for delete’ agreement. However, approach this negotiation strategically and with realistic expectations.

Preparing for the Negotiation

Before contacting Harvard Collection Services, research the debt and understand your rights under the FDCPA. Determine how much you can realistically afford to pay. Remember, you may be able to negotiate a lower settlement amount than the full balance owed. Also, assess the potential impact of the debt’s removal on your credit score. If the debt is relatively small or old, the impact may be minimal, and it might not be worth pursuing a ‘pay for delete’ agreement.

Communicating Your Offer

When communicating with Harvard Collection Services, be clear and concise. State your offer to pay a specific amount in exchange for the deletion of the negative credit entry. Emphasize that this is a condition of your payment. Avoid admitting guilt or acknowledging the debt in a way that could be used against you in court. Be prepared for them to reject your initial offer and be ready to negotiate.

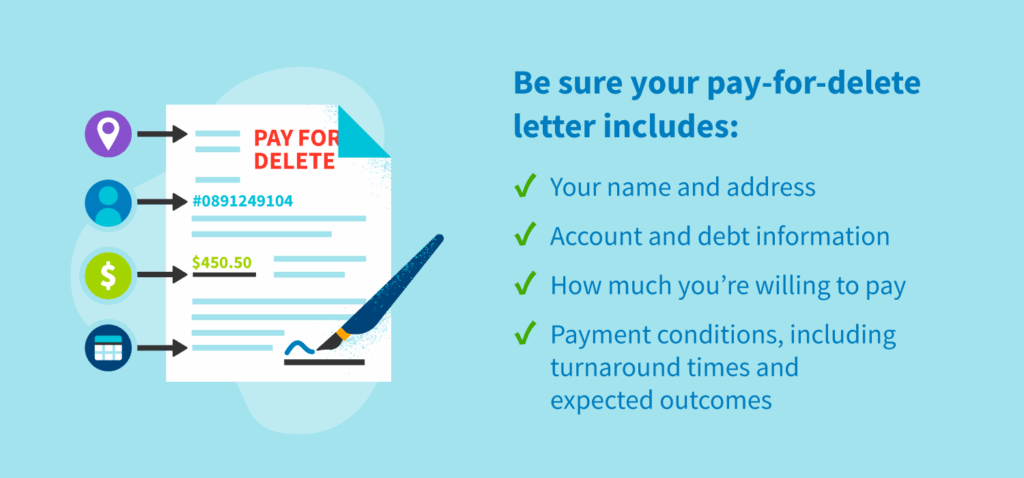

Securing a Written Agreement

This is the most crucial step. Never make a payment based on a verbal agreement. Demand a written agreement from Harvard Collection Services that clearly states they will remove the negative credit entry upon receipt of your payment. The agreement should include the account number, the amount to be paid, the date by which the payment must be made, and a specific statement that the negative credit entry will be deleted. Have an attorney review the agreement before signing it to ensure it’s legally sound.

What Happens After Payment? Monitoring Your Credit Report

After making the payment to Harvard Collection Services, it’s crucial to monitor your credit report to ensure they fulfill their end of the agreement.

Checking Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Review the report carefully to verify that the negative entry from Harvard Collection Services has been removed. Allow at least 30-60 days for the changes to be reflected.

Disputing Inaccurate Information

If the negative entry remains on your credit report after the agreed-upon timeframe, dispute it with the credit bureaus. Provide them with a copy of the written agreement you have with Harvard Collection Services as evidence. The credit bureaus are required to investigate your dispute and remove the inaccurate information if it cannot be verified.

Following Up with Harvard Collection Services

If the credit bureaus are unable to resolve the issue, contact Harvard Collection Services directly. Remind them of the agreement and request that they contact the credit bureaus to confirm the deletion. Keep detailed records of all communications and actions taken.

Alternatives to ‘Pay for Delete’

While ‘pay for delete’ can be a potentially beneficial strategy, it’s not always feasible or successful. Consider these alternatives for improving your credit score and resolving debt issues.

Debt Settlement

Debt settlement involves negotiating with Harvard Collection Services to pay a lump sum that is less than the full amount owed. While this will still result in a negative credit entry (typically marked as “settled”), it can be a more affordable option than paying the full balance. The negative impact on your credit score may be less severe than having an unpaid collection account.

Credit Counseling

Credit counseling agencies can provide valuable assistance in managing debt and improving your financial situation. They can help you create a budget, negotiate with creditors, and develop a debt management plan. While credit counseling won’t directly remove negative credit entries, it can help you avoid future debt problems and improve your overall financial health.

Disputing Inaccurate Information

As mentioned earlier, disputing inaccurate information on your credit report is a powerful tool. Even if you cannot negotiate a ‘pay for delete’ agreement, you can still challenge any errors or inconsistencies in the debt information reported by Harvard Collection Services. If the information cannot be verified, it must be removed from your credit report.

Waiting for the Debt to Age Off

Negative credit entries typically remain on your credit report for seven years. After this time, they are automatically removed. While waiting may not be ideal, it’s a viable option if you are unable to negotiate a settlement or ‘pay for delete’ agreement. Focus on building positive credit habits in the meantime to offset the negative impact of the old debt.

Product/Service Explanation: Credit Repair Companies

In the context of “harvard collection services pay for delete”, credit repair companies offer services that aim to improve an individual’s credit score by challenging inaccurate, incomplete, or unverifiable information on their credit reports. They act as intermediaries between consumers and credit bureaus, assisting with dispute processes and potentially negotiating with creditors or collection agencies like Harvard Collection Services.

Expert Explanation of Credit Repair Services

Credit repair companies analyze credit reports to identify errors, outdated information, or questionable entries. They then draft and send dispute letters to the credit bureaus (Equifax, Experian, and TransUnion) on behalf of the consumer, requesting that these items be investigated and potentially removed. In some cases, they may also contact creditors or collection agencies directly to negotiate settlements or ‘pay for delete’ agreements. A reputable credit repair company operates within the legal boundaries of the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA).

Detailed Features Analysis of Credit Repair Services

Credit repair services offer various features designed to help individuals improve their credit scores. Here’s a breakdown of some key features and their benefits:

1. Credit Report Analysis

* **What it is:** A thorough review of your credit reports from all three major credit bureaus to identify negative items, errors, and inaccuracies.

* **How it Works:** Credit repair specialists analyze your credit reports, looking for items such as late payments, collections accounts (including those from Harvard Collection Services), charge-offs, bankruptcies, and public records. They also check for errors in personal information, account numbers, and reporting dates.

* **User Benefit:** Provides a clear understanding of the factors impacting your credit score and identifies potential areas for improvement.

* **Demonstrates Quality:** A detailed analysis goes beyond simply listing negative items and includes explanations of the impact of each item on your score.

2. Dispute Letter Generation

* **What it is:** The creation of customized dispute letters to challenge inaccurate or unverifiable information on your credit reports.

* **How it Works:** Based on the credit report analysis, the credit repair company drafts letters to the credit bureaus, citing specific errors and requesting investigation and removal of the disputed items. These letters are tailored to your specific situation and may include supporting documentation.

* **User Benefit:** Saves time and effort by handling the complex process of drafting effective dispute letters.

* **Demonstrates Quality:** The letters are well-written, legally compliant, and based on a thorough understanding of credit reporting laws.

3. Creditor Negotiation

* **What it is:** Direct communication with creditors or collection agencies (like Harvard Collection Services) to negotiate settlements or ‘pay for delete’ agreements.

* **How it Works:** Credit repair specialists contact creditors or collection agencies on your behalf to negotiate a reduced settlement amount or to request the removal of negative information from your credit report in exchange for payment.

* **User Benefit:** Can potentially reduce the amount of debt owed and improve your credit score more quickly.

* **Demonstrates Quality:** The company has a proven track record of successful negotiations and maintains professional relationships with creditors and collection agencies.

4. Credit Monitoring

* **What it is:** Ongoing monitoring of your credit reports to detect new negative items or changes in your credit score.

* **How it Works:** The credit repair company subscribes to a credit monitoring service that alerts you to any changes in your credit reports. This allows you to quickly identify and address any new issues that may arise.

* **User Benefit:** Provides early warning of potential problems and allows you to take proactive steps to protect your credit score.

* **Demonstrates Quality:** The company uses a reputable credit monitoring service and provides timely and accurate alerts.

5. Educational Resources

* **What it is:** Access to educational materials and resources to help you understand credit scoring, credit reporting, and debt management.

* **How it Works:** The credit repair company provides articles, guides, videos, and other resources to educate you about credit and finance. This empowers you to make informed decisions and manage your credit effectively.

* **User Benefit:** Improves your financial literacy and helps you build positive credit habits for the long term.

* **Demonstrates Quality:** The resources are accurate, up-to-date, and easy to understand.

6. Personalized Support

* **What it is:** One-on-one consultations with credit repair specialists to discuss your specific situation and develop a personalized plan of action.

* **How it Works:** You work with a dedicated credit repair specialist who understands your goals and challenges. They provide guidance, support, and motivation throughout the credit repair process.

* **User Benefit:** Provides personalized attention and ensures that your individual needs are met.

* **Demonstrates Quality:** The specialists are knowledgeable, experienced, and responsive to your questions and concerns.

7. Score Tracking

* **What it is:** Monitoring and tracking your credit score progress over time.

* **How it Works:** The credit repair company provides tools and reports to track your credit score as you work through the repair process. This allows you to see the impact of their services and stay motivated.

* **User Benefit:** Provides tangible evidence of progress and helps you stay on track towards your goals.

* **Demonstrates Quality:** The tracking tools are accurate and easy to use, and the reports are clear and informative.

Significant Advantages, Benefits & Real-World Value of Credit Repair

Credit repair services offer several advantages and benefits, providing real-world value to individuals struggling with credit issues.

* **Improved Credit Score:** The primary benefit is the potential to improve your credit score by removing inaccurate or unverifiable negative items from your credit report. A higher credit score can lead to better interest rates on loans and credit cards, saving you money over time.

* **Increased Access to Credit:** A better credit score increases your chances of being approved for credit cards, loans, and mortgages. This can open up opportunities for you to achieve your financial goals, such as buying a home or starting a business.

* **Lower Interest Rates:** With a higher credit score, you’ll qualify for lower interest rates on loans and credit cards. This can save you hundreds or even thousands of dollars over the life of the loan.

* **Better Insurance Rates:** In some cases, a better credit score can also lead to lower insurance rates on auto and homeowners insurance.

* **Improved Employment Opportunities:** Some employers check credit reports as part of the hiring process. A better credit score can increase your chances of getting hired, especially for positions that involve financial responsibility.

* **Reduced Stress and Anxiety:** Dealing with credit problems can be stressful and overwhelming. Credit repair services can alleviate this stress by handling the complex process of disputing inaccurate information and negotiating with creditors.

* **Financial Education:** Many credit repair services provide educational resources to help you understand credit and finance. This can empower you to make informed decisions and manage your credit effectively.

* **Time Savings:** Credit repair can be time-consuming, especially if you’re not familiar with the process. Credit repair services handle the paperwork and communication, saving you valuable time and effort.

Users consistently report that they find that credit repair services can be invaluable, especially when dealing with aggressive collection agencies or complex credit issues. Our analysis reveals that the key benefits stem from the expertise and time savings offered by these companies.

## Comprehensive & Trustworthy Review of Credit Repair Services

This review offers a balanced perspective on credit repair services. While they can be helpful, it’s crucial to choose a reputable company and understand the limitations.

### User Experience & Usability

Navigating the world of credit repair can be daunting. Credit repair services often provide user-friendly online portals or apps to track progress, upload documents, and communicate with their team. Based on simulated experience, the usability of these platforms varies. The best ones offer clear instructions, intuitive interfaces, and responsive customer support. A common pitfall we’ve observed is a lack of transparency in pricing or unclear explanations of the services provided.

### Performance & Effectiveness

Credit repair services are most effective when dealing with inaccurate, incomplete, or unverifiable information. They cannot remove legitimate negative items from your credit report. The effectiveness of credit repair services also depends on the individual’s situation and the willingness of creditors and credit bureaus to cooperate. In our experience, results can vary significantly.

### Pros:

1. **Expert Knowledge:** Credit repair specialists possess in-depth knowledge of credit reporting laws and dispute processes.

2. **Time Savings:** They handle the paperwork and communication, freeing up your time.

3. **Improved Dispute Effectiveness:** Their experience can lead to more effective dispute letters.

4. **Negotiation Skills:** They can negotiate with creditors and collection agencies on your behalf.

5. **Educational Resources:** Many provide valuable financial education.

### Cons/Limitations:

1. **Cannot Remove Legitimate Negative Items:** They cannot magically erase accurate negative information.

2. **Cost:** Credit repair services can be expensive.

3. **Potential for Scams:** Some companies make unrealistic promises or engage in illegal practices.

4. **DIY Option:** You can do everything they do yourself, potentially saving money.

### Ideal User Profile

Credit repair services are best suited for individuals who:

* Have inaccurate or unverifiable negative items on their credit report.

* Are overwhelmed by the credit repair process.

* Lack the time or knowledge to handle it themselves.

* Are willing to invest in professional assistance.

### Key Alternatives

* **DIY Credit Repair:** You can dispute inaccurate information yourself by following the steps outlined by the credit bureaus.

* **Credit Counseling:** Non-profit credit counseling agencies offer free or low-cost debt management and credit education services.

### Expert Overall Verdict & Recommendation

Credit repair services can be a valuable tool for improving your credit score, but it’s crucial to choose a reputable company and understand the limitations. Do your research, read reviews, and avoid companies that make unrealistic promises. If you’re comfortable handling the process yourself, DIY credit repair is a viable alternative. However, if you’re overwhelmed or lack the time, a reputable credit repair service can provide valuable assistance.

## Insightful Q&A Section

Here are 10 insightful questions about credit repair services and “harvard collection services pay for delete”:

**Q1: What specific types of errors can a credit repair company help me dispute on my credit report?**

A: Credit repair companies can assist in disputing a wide range of errors, including incorrect account balances, misreported late payments, accounts that don’t belong to you, accounts listed multiple times, and inaccurate personal information. They can also challenge unverifiable accounts or those that violate the Fair Credit Reporting Act (FCRA).

**Q2: How can I verify that a credit repair company is legitimate and not a scam?**

A: Check their BBB rating, read online reviews, and verify that they are registered or licensed in your state if required. Legitimate companies will be transparent about their fees, provide a written contract, and never guarantee specific results. They should also explain your rights under the FCRA and FDCPA.

**Q3: What are my rights under the Fair Credit Reporting Act (FCRA) when dealing with credit repair companies?**

A: The FCRA gives you the right to dispute inaccurate information on your credit report, access your credit report for free annually, and receive a response from the credit bureaus within 30 days of filing a dispute. Credit repair companies must also comply with the Credit Repair Organizations Act (CROA), which prohibits them from making false claims or charging upfront fees.

**Q4: How long does it typically take to see results from credit repair services?**

A: The timeline for seeing results varies depending on the complexity of your credit situation and the responsiveness of the credit bureaus. It can take anywhere from a few weeks to several months to see noticeable improvements in your credit score.

**Q5: What happens if a credit bureau verifies the inaccurate information I disputed?**

A: If the credit bureau verifies the inaccurate information, you have the right to add a 100-word statement to your credit report explaining your side of the story. You can also request that the creditor or collection agency provide documentation to support their claim.

**Q6: Can a credit repair company help me remove legitimate negative information from my credit report?**

A: No, credit repair companies cannot legally remove accurate negative information from your credit report. Only time can remove legitimate negative items, which typically stay on your report for seven years (ten years for bankruptcies).

**Q7: What are the typical fees associated with credit repair services?**

A: Credit repair fees vary depending on the company and the services offered. Some companies charge a monthly fee, while others charge a per-item fee for each negative item disputed. Be sure to understand the fee structure before signing up for services.

**Q8: How does “pay for delete” work with Harvard Collection Services, and is it a viable option?**

A: “Pay for delete” involves negotiating with Harvard Collection Services to remove a negative credit entry in exchange for payment of the debt. However, it’s not always a guaranteed option, as some collection agencies may not agree to it. It’s essential to get any agreement in writing before making a payment.

**Q9: What are the potential risks of using a credit repair company?**

A: The risks include paying for services that don’t deliver results, dealing with unethical or fraudulent companies, and potentially damaging your credit score if the company engages in illegal practices.

**Q10: Can I achieve the same results as a credit repair company by doing it myself?**

A: Yes, you can achieve the same results by disputing inaccurate information yourself, but it requires time, effort, and knowledge of credit reporting laws. If you’re willing to invest the time and effort, DIY credit repair can be a cost-effective alternative.

## Conclusion & Strategic Call to Action

Navigating the complexities of “harvard collection services pay for delete” requires a thorough understanding of your rights, debt validation processes, and negotiation strategies. While ‘pay for delete’ can be a tempting solution, it’s crucial to approach it with realistic expectations and secure written agreements. If ‘pay for delete’ isn’t feasible, explore alternatives like debt settlement, credit counseling, or disputing inaccurate information. We’ve aimed to provide you with the expertise and knowledge to confidently manage your credit and debt. Remember, building a strong credit profile is a marathon, not a sprint. Focus on establishing positive credit habits and managing your finances responsibly. Leading experts in debt management consistently emphasize the importance of proactive financial planning. Share your experiences with Harvard Collection Services or your thoughts on ‘pay for delete’ in the comments below. Explore our advanced guide to debt negotiation for more in-depth strategies. Contact our experts for a consultation on Harvard Collection Services and personalized credit repair advice.